Fear, shame, and helplessness are feelings Minnesota fraud victims describe after losing their life savings to a scam.

They're hopeful about a path to financial recovery as state lawmakers finalize a new tool to lean on.

Under a bill poised for final passage, Minnesota would join a handful of other states in creating a Consumer Fraud Restitution Fund.

A percentage of money collected from civil penalties leveled against suspected fraudsters would be diverted into a state-managed account.

That money would be divvied up among people who've had trouble recovering money in their cases.

Dennis Anderson of Maplewood told lawmakers that was the situation for him.

"It can happen to anyone," said Anderson. "Scammers exploit emotions and fears, robbing us from our financial security."

Anderson lost $20,000 after getting a frantic call from someone posing as his grandson about a legal matter.

The legislation is now part of a large omnibus bill as lawmakers near the end of session.

The measure has bipartisan support, although some Republicans want more transparency in how the money is handled. Sponsors say the plan has enough guardrails.

State Senator Ann Rest, DFL-New Hope, is the bill's main sponsor.

She said those guardrails include caps on how much money can go into the restitution fund, before the rest is moved into the general fund.

She noted that they also added language that a victim who receives restitution won't have to list it on their tax return. Rest said it's one way to make them feel better moving on from what happened.

"People lose their dignity over it," said Rest. "Sometimes they have risked a lot of their retirement income. They feel embarrassed, and by having a restitution account, it allows some restoration of that dignity."

AARP Minnesota worked closely with lawmakers on this plan.

It highlights data from the first three quarters of 2024, when the Federal Trade Commission received more than 22,000 fraud reports from Minnesotans, with losses totaling nearly $103 million.

-

Plus: The Brainerd Police Chief will retire early due to cancer; a new solar cooperative is forming in north-central MN; and MN DEED recently awarded more than $7 million in housing infrastructure grants.

-

A motion was filed after Bemidji received a letter from Northern Township offering to connect to the city's existing wastewater plant rather than building its own new one.

-

"What's for Breakfast" guests Kathy Lee and Kathy Kooda from Grand Rapids have been delivering donations to families in need in the Twin Cities due to the impact of Operation Metro Surge.

-

The March 3, 2026, incident involved a private piece of older equipment on private property.

-

KAXE's weekly list of concerts near you features Charley Wagner, Rich Mattson, Packsacker Stringband, and the Grant Edwards Band.

-

The co-op is free and open to homeowners and business owners in Cass, Crow Wing, Morrison, Todd and Wadena. Members will leverage their numbers to buy solar energy at a competitive price.

-

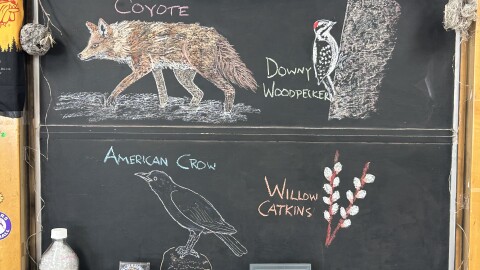

During the week of March 3, 2026, we enjoy reports of Red-winged Blackbirds, temperature swings, and courting squirrels. Staff phenologist John Latimer responds.

-

Plus: Bemidji School Board votes to close J.W. Smith Elementary; Hibbing considers closing Greenhaven Elementary; and Google revealed to be owner of propsed Hermantown data center.

-

The March 4, 2026, vote would start the process of a closure, which would save the district an estimated $516,000. The Board will also give an update on contract negotiations with support staff.

-

The school district must now advertise the planned closure for two weeks before hosting a public hearing on the decision, which would go into effect this spring.