This story was originally published by MinnPost.

The 2023 session of the Minnesota Legislature finished Monday evening, on time and on budget — the largest budget, by far, in state history.

For just the eighth time in 40 years, a budget session did not require a special session to finish its work. That was just one of the changes in this session that resulted from a DFL trifecta — controlling the governor’s office, the House and Senate.

The bigger change was that the veto Republicans have held over DFL bills by controlling either the House or the Senate or both for the last decade no longer applied. DFL leaders also held narrow majorities together throughout and enacted nearly their entire legislative agenda.

MinnPost reporter Walker Orenstein joined the KAXE Morning Show to share what happened at the Minnesota Legislature this year, especially the effects on rural Minnesota. Listen above.

State budget: State lawmakers’ primary job following an election year is to create a balanced two-year state budget. This year that job was made easier — and perhaps harder in a way — by the continuation of record surpluses. Whereas not very long ago surpluses of $1 billion to $1.5 billion were considered generous, this Legislature started with a $17.5 billion surplus.

It was expected, then, that each of the budget omnibus bills could be described as historic because they all spent more than what was passed with less-ample tax collections and surpluses two years ago when DFLers and Republicans shared power.

But DFL budgets didn’t just break records, they smashed them. The current state budget spends $51.6 billion over two years. The budget adopted in various omnibus bills totals $71.5 billion — a 40% increase in spending. To fund that budget into the following biennial budget beginning July 1, 2025, the state will need $66.1 billion. The decline reflects how much of this upcoming two-year budget is one-time spending, as much of the surplus is one-time money made possible in part by an infusion of federal cash into the state during the pandemic.

There were tax relief measures included, totalling $3 billion. They include the changes to taxation of social security, rebate checks and child tax credits. But there are also $1 billion of general fund tax hikes, $1,48 billion in transportation tax hikes and $1 billion in shared payroll taxes between employers and employees for a new paid family leave program.

One-time rebates: Lawmakers approved $1.15 billion worth of one-time rebates, enough for $260 for individuals, $520 for married couples and an extra $260 for every child, up to a $1,300 maximum. They are only available to joint filers with less than $150,000 in household income or single filers with less than $75,000. Republicans argued the rebates were meager, while DFL lawmakers and the governor said they were only one way Minnesotans would benefit from the larger budget plan passed by Democrats.

Child tax credit: One major part of the DFL tax bill offers refundable tax credits for parents, mainly for low-to-middle income families. Eligible families can get $1,750 for every child, and the money has ties to a separate earned income credit that can boost the credit by $350. The credit begins to phase out at $35,000 of adjusted gross income for joint filers. The income at which the credit is fully phased out is higher when parents have more kids. For example, married joint filers with four kids under age 18 could get some credit at an income lower than $96,250.

Local Government Aid: City and county officials throughout the state asked lawmakers for more money for basic services to offset rising costs from inflation and stave off higher property taxes. Those legislators approved an $80 million-a-year hike for Local Government Aid and County Program Aid — a significant hike for the two subsidies. Before the increase, the state spent about $564 million a year on LGA, which mostly flows to cities in Greater Minnesota, and $256 million on CPA.

Bonding and infrastructure: After an up-and-down saga, lawmakers approved a $2.6 billion package of infrastructure projects on the final day of the legislative session. Two capital investment bills — one cash, one financed through government borrowing — were made possible by a last-minute deal that directed $300 million toward struggling nursing homes. That secured enough Republican votes in the Senate to clear a 60% supermajority requirement for bonding bills. The legislation funds things like roads, bridges, water infrastructure, parks, trails, college buildings, public interest nonprofits, ice arenas, ski hills, and more. It’s the biggest capital investment package in state history, coming on the heels of a historic two-year drought for bonding.

Social Security taxes: A compromise tax deal between Democrats will expand the number of people who won’t have to pay Minnesota’s tax on Social Security benefits, but it won’t eliminate the state tax entirely. Married filers with a federally adjusted gross income below $100,000 and individuals earning up to $78,000 won’t have to pay Social Security taxes. The cut will phase out, for married couples, by $140,000. The plan does not alter the federal tax on those benefits.

Broadband infrastructure: Lawmakers approved $100 million in new state spending to help subsidize infrastructure for high-speed internet. That was less than what Gov. Tim Walz’s administration and some DFLers wanted, and it trailed behind the type of money broadband advocates asked for. But it was still the largest amount of state money approved by lawmakers at one time for broadband.

Cannabis: Minnesota became the 23rd state to legalize marijuana for recreational uses, nine years after it created a medical marijuana program. The bill, expected to be signed next week, would start the clock toward an Aug. 1 decriminalization of simple possession and home growing of marijuana — the only legal source until retail sales begin. But it will take up to 18 months for the legal apparatus — creating a state office, writing rules and taking applications for the dozen or more licenses created by the bill — to be established.

A medical system will remain, though folded into a new Office of Cannabis Management. The hemp-derived edibles market created last summer will also be governed by that office but will now be subject to licensing, regulation and taxation. There will be no limit on the numbers of retailers selling gummies and beverages. Local governments can apply zoning to cannabis retailers and can cap the number of stores at one for every 12,500 residents.

Abortion access: Lawmakers passed several bills aimed at cementing access to abortion in Minnesota, including one that says the procedure is a “fundamental right,” and another that seeks to shield people who travel to Minnesota for an abortion from penalties in other states where it’s illegal. In a late-session deal, the Legislature also repealed — over Republican objections — many of the abortion restrictions left in state law. Most of those limits have already been struck down by either state or federal courts but remained on Minnesota’s books.

Gun regulations: The Legislature approved two major gun restrictions. One extends certain background check requirements to private firearm transfers. Another allows people to petition a judge, asking to have another person’s guns seized if they’re deemed by the court to be a threat to themselves or others. Some more centrist Democrats blocked several other gun bills along with Republicans, who had objected to nearly all gun legislation proposed by DFL lawmakers.

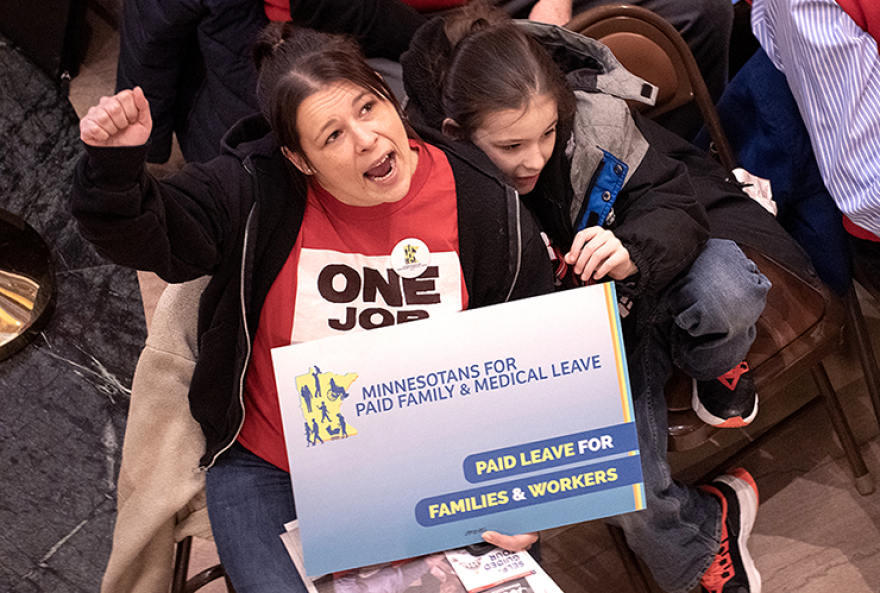

Paid family leave: This was another top priority of DFLers, marked by being House File 2 and Senate File 2, just after the abortion rights bills. Much of what was proposed was passed into law, though sponsors made some changes along the way, such as reducing the number of weeks of paid leave available and putting off the start of the program.

The basics are that Minnesota will join 11 states in creating a paid family and medical leave plan similar to unemployment insurance. Employers and employees would split a 0.7 percent payroll tax to cover the costs of providing paid leave for childbirth, illness or medical needs for workers and for them to care for family members. Benefits can run for up to 18 weeks and would begin in 2026. Because the state put $648 million into the program, the payroll taxes can begin being collected at the same time benefits begin. Without that, the taxes would need to accumulate a fund before benefits could be paid.

Separate legislation enacted a statewide sick leave program where workers can accrue an hour of sick leave for every 30 hours worked.

Transportation: Unlike the general fund with its surpluses fueled largely by the federal influx of pandemic relief, transportation taxes did not see the same increases. Collections for gas taxes, car tabs and car sales taxes continued to fall behind inflation and left roads, bridges and transit with less than planners say is needed.

But increasing the gas tax has been political poison for decades, leaving the two transportation chairs looking for alternatives. In the end, Sen. Scott Dibble and Rep. Frank Hornstein went both new and old — a new 50-cent fee on package deliveries (with lots of exemptions), a seven-county metro sales tax of 0.75% for transit and a plan to increase the gas tax by inflation. All together, the new taxes raise $1.48 billion over two years with $924 million of that from the metro sales tax.

Light rail safety: The same transportation bill includes money to fund a rapid intervention to secure rail cars and stations after increases in crime and disruptions on both. A high-profile team of social workers and police will mobilize soon to get help for those with substance abuse or mental health issues and then enforce a new code of conduct for riders. That will be followed by the deployment of civilian workers to enforce fares and also summon transit police when needed to enforce laws and the conduct code.

Housing: There is no dedicated source of money for affordable housing, leaving the issue to battle for money in the general fund budget and in the bonding bills. While housing did very well in those efforts this session — quintupling the historic share of funding — it will also benefit from the first-ever dedicated source of money for affordable housing programs and projects from a 0.25% seven county metro sales tax.

“A billion dollars. That’s a number I’m going to have to get used to,” said state Housing Commissioner Jennifer Leimaile Ho. The budget includes a state-funded rental assistance program plus help for first-generation homebuyers. There was also funding in the health and human services budget for capital improvements to homeless shelters, emergency services, youth shelters and shelters for those facing abuse and sex trafficking.

Child care: The Legislature agreed to spend $146 million in this two-year budget to significantly hike reimbursement rates in the Child Care Assistance Program, the main subsidy for low-income families. That’s long been a priority of Democrats who say better CCAP rates will help parents afford child care and help providers make more money and take on more kids using the program. Lawmakers also approved $316 million for ongoing payments for child care workers, continuing with state money a federal pandemic-era program meant to raise salaries that are often dismally low. And legislators passed more money for early learning scholarships, another program meant to help low-income families pay for high-quality child care. Combined with other child care spending, it was a massive influx of cash for an industry that has struggled for years.

Transgender refuge: The Legislature passed a bill meant to shield people who get gender-affirming health care in Minnesota from legal action in states with criminal or civil penalties for those services. For instance, it says the governor can’t extradite someone for receiving gender-affirming care in Minnesota.

Ban on conversion therapy: Mental health providers are now banned from trying to change the sexual orientation or gender identity of minors or certain vulnerable adults, restricting the practice of what is commonly referred to as “conversion therapy.” The new law also says nobody can market services that infer homosexuality is a mental disease, disorder or illness, or guarantee they can change a person’s sexual orientation or gender identity.

No-knock search warrants: There will be sharp new limits on no-knock search warrants, changes in law sought by DFL lawmakers after police killed Amir Locke in Minneapolis last year. Courts can’t issue a no-knock search warrant unless police show the search can’t be done when nobody is home, or people in the premises represent an “imminent threat of death or great bodily harm” to officers or others.

Public safety aid: In a large tax bill, legislators approved $300 million in public safety aid for local governments. The money was a priority for Walz and was a centerpiece of his plans to respond to violent crime and other public safety issues. House Democrats — and some local government officials — were initially wary of the cash for several reasons. Some cities said the one-time money couldn’t help them pay for new police officers in future years, for example.

Rural prosecutors: The Legislature approved about $4.3 million for Attorney General Keith Ellison to hire more criminal prosecutors that most often help county attorneys in rural areas with complex cases like murder. Republicans had blocked the proposal for years, objecting in part to other work by Ellison or saying he had enough money within his office. On the campaign trail in 2022, Republican candidate Jim Schultz pushed for a much larger criminal division at the office. But when Ellison won, and DFLers won majorities in the House and Senate, the AG’s plan was quickly approved.

Restore the vote/ban the box/felony murder: A series of bills resolved some long-standing criminal justice issues, again thanks to DFL control. A bill to change when former felons are allowed to vote again — at their release from prison or jail rather than having to wait until the end of their probation — could allow up to 55,000 residents to register. The Legislature also added state boards and commission applications to existing bans on asking job applicants about their criminal histories. And the Legislature enacted reforms to what is known as the felony murder rule that assigns criminal liability to people who may have aided and abetted in a crime but didn’t take part.

Drivers licenses for all: Yet another long-simmering issue was resolved after 20 years when the Legislature passed a bill allowing people who are undocumented immigrants to receive driver’s licenses. The change was supported by immigrant rights advocates as well as law enforcement leaders who reasoned roads are safer if all drivers are taught and tested before driving.

Voting access: In response to the Jan. 6, 2021, insurrection at the U.S. Capitol, DFLers introduced a series of bills to protect ballot places and poll workers and expand voting access. The Democracy for the People Act will allow 16-year-olds to preregister to vote and create a permanent absentee ballot system. It also includes automatic voter registration, which could reduce the number of residents — currently 575,000 — who are eligible to vote but not registered. The changes also restrict the ability of those who fund ads that appear to advocate for or against candidates or issues from escaping disclosure.

School lunch: During the pandemic, federal school lunch rules were changed to let districts get reimbursed for breakfasts and lunches provided to all students regardless of whether they met income requirements. That benefit ended with emergency declarations, and districts went back to charging for meals or going through the process of determining which students were eligible for free or reduced-price meals. A bill adopted this year put state money aside to pay the difference between federal lunch funds and what is needed to provide free meals to all students, starting with the next school year.

Reading: Transformational was a word used a lot this session, but it might be most apt for changes made to how the state teaches young students to read. What had been known as the reading wars has been settled with the state mandating new curricula that embrace what is known as evidence-based teaching or the science of reading. Either way, it will require returning to phonics-based instruction in early years and also creates and pays for interventions to diagnose dyslexia and other reading disabilities and to measure student progress in reading.

It was just part of an education budget that both increased funding for schools and adjusted funding for future inflation and added new requirements for districts.

Energy and climate: The two most significant pieces of energy policy this year were likely the requirement for a carbon-free electric grid by 2040 and a $115 million fund to match federal dollars for climate and energy projects in Minnesota. But legislators did approve spending on rebates and grants for things like electric vehicles, electric school buses, air-source heat pumps and more. And DFL lawmakers passed other regulatory requirements for utilities, like planning requirements for EVs.

Fees on outdoor recreation: Minnesota’s Department of Natural Resources asked for an array of increases to outdoor permits like fishing licenses and state parks passes to help fund their services, which drew some consternation among lawmakers given the $17.5 billion surplus. The Legislature did approve an increase to boat registration fees, which hadn’t been raised since 2006, but did not hike the cost of other permits on outdoor recreation.

Environment trust fund: Lawmakers sent a constitutional amendment to the ballot in 2024 for voters to decide whether to renew lottery funding for the Environment and Natural Resources Trust Fund. The link between the state lottery and the fund, which funds environmental spending, is set to expire in 2025. The amendment would extend the program until 2050. Some changes were proposed, like a ban on using the money for bonding or upgrades to wastewater infrastructure. And the amount of money from the trust fund that can be spent each year would increase to help pay for a new grant program within the initiative aimed at smaller nonprofits, especially in areas “that have been adversely affected by pollution and environmental degradation,” the proposal says.

Hair discrimination: Early in the session, the Legislature passed and Walz signed the CROWN Act, which stands for Creating a Respectful and Open World for Natural Hair. The change to the Minnesota Human Rights Act that protects against discrimination in employment, housing and education wasn’t especially controversial, passing the House 111-19 and the Senate 45-19. But the Senate vote came after an unsuccessful attempt was made to include the word “beards.”

What failed

Sports betting: When the state’s tribal governments found a version of sports betting that they could support — one that gave most of the betting action to them — the way seemed clear for passage. Democrats have endorsed a standard that provides the tribal government exclusivity over expansions as a way to ensure the economic benefits remain in Indian County.

But DFL sponsors ran into a problem when they could not retain enough votes in the Senate, losing a handful of votes from members who oppose expansions due to the social impacts of problem gambling and financial losses. That left backers in need of GOP votes and none were available unless the bill also helped the two horse tracks, either by sharing the action or helping them financially. A willingness by DFL sponsors to do so fell apart on yet another tribes-tracks dispute over how much aid to the tracks was too much.

Ranked choice voting: Even though the final state government and elections budget bill does mention ranked choice voting, what started the session as a move to using the voting method on statewide and congressional races by 2026 ended as a secretary of state study of “issues related to voter engagement, education and improvements to the education system, which can include but is not limited to assessing ranked choice voting.”

The system ranks candidates and, after dropping the candidates with the fewest votes, assigns votes to remaining candidates based on voters’ second and third choices. It is used by five cities in Minnesota: Minneapolis, St. Paul, Bloomington, St. Louis Park and Minnetonka. But expanding it to state offices raised concerns from county elections officials, who would have to run such an election for offices that cross county lines. An interim report is due next February.

5th tier income tax and capital gains surcharges: House DFLers wanted to add a 5th tier income tax bracket for high earners. Gov. Tim Walz wanted to collect a surcharge on large capital gains — profits from the sale of investments such as stocks. Both were aimed at increasing taxes on wealthier Minnesotans. Neither passed in the end.

Worldwide combined reporting: Just as people who follow the Legislature were coming to understand this change to the corporate franchise tax, it went away, despite having passed both the House and Senate. Oversimplified, worldwide combined reporting asks corporations to include income from foreign subsidiaries and assess whether it has some nexus to its operations within Minnesota. No other nations and only Alaska — partially — tries to collect taxes this way.

It was replaced by a tax change that is less productive but similarly attempts to discourage the movement of taxable income to countries with low taxes. If multinational corporations insist on moving income to so-called tax havens, GILTI — global intangible low tax income — will capture some of it for state tax accounts.

Uber fee: When the delivery fee was proposed for transportation projects, a separate charge was introduced for rides on Ubers and Lyfts, referred in the bill as transportation network companies. A similar fee is assessed in Colorado on rides. But the fee was quickly dropped because of the complexity of implementing it and because it raised only $20 million — a case of the juice not being worth the squeeze.

Keeping Nurses at the bedside: Red-shirted members of the Minnesota Nurses Association were a fixture around the Capitol during the 2023 session, especially in the closing days when they conducted a sit-in outside the governor’s office. Their mission was to pass what was dubbed the Keep Nurses at the Bedside Act that would set minimum staffing levels and mandate management-labor committees to discuss and resolve issues over safe staffing levels.

With strong DFL support, the bill was moving through the House and Senate but slowed when Mayo Clinic said it would reconsider investments in Rochester if the bill passed. Dubbed blackmail by the union and the bill’s sponsors, Walz insisted that Mayo be exempted from the provisions. That special treatment caused other hospital systems to ask, “What about us?” In the end, the staffing provisions were stripped from the bill, and it became an effort to prevent violence against nurses and study burnout and departures from the work. The name was changed to Nurse and Patient Safety Act, and the union vowed to return to the issue next session.

Equal Rights Amendment: Time ran out for an effort to put an Equal Rights Amendment before Minnesota voters. The amendment would be a change to the state constitution guaranteeing rights regardless of gender. House Speaker Melissa Hortman has said lawmakers needed more time to work out details but she expects the Legislature will take up the measure during the next session.

‘Great Start’ child care credit: One of the major DFL tax ideas to fall by the wayside was aimed at reimbursing the high cost of child care. The ‘Great Start’ credit was in a Senate budget plan, had higher income thresholds than other tax proposals made by the DFL and was more generous for parents with kids under age five. But lawmakers opted instead for the child tax credit, which is meant to be an anti-poverty measure limited to parents with lower incomes.

This article first appeared on MinnPost and is republished here under a Creative Commons license.